Product Updates

All the latest updates, improvements, and fixes to Fundra.app

Stay up to date

Subscribe to our newsletter to get the latest (but infrequent) updates delivered to your inbox.

Granola IntegrationIntegrations

Bring your board meeting context into Fundra for 360° visibility on your portfolio performance.

Board meetings contain some of the most important context in a portfolio: what's actually happening, what changed since last quarter, where risks are emerging, and what decisions were made.

Fundra now integrates with Granola.ai to bring board meeting notes directly into Fundra. Board discussions sit alongside KPIs, financials, and updates — so qualitative context isn't lost or siloed.

Everything shared with your team, breaking down silos to help share learnings and ensuring everyone is on the same page.

What's new?

Board meeting notes synced from Granola into the relevant company

Full context preserved from Granola, including attendees, enhanced notes, and meeting transcripts

Use board context to generate richer LP updates, summarize portfolio performance, identify risks, and track action items over time

Using a different note-taking tool? Tell us which one — we're continuing to expand Fundra's integrations.

Automatic KPI Extraction from Investor UpdatesAI

Automatic KPI extraction for your portfolio companies, straight from the investor updates you already receive – no manual input required.

VCs have access to a wealth of data about the performance of their portfolio companies, but after speaking well over 200 investors since we launched, one thing is clear: even the best ones don't manage to make full use of it.

The state of the art is either manual data entry or sending forms to the founders to fill (which they hate). Not only is it inefficient, it also lags behind actual reporting, and has a fairly narrow scope relative to the full picture of a company's performance. As a result, this data gets at best used for quarterly reporting to LPs.

Meanwhile, the data already exists.

Portfolio KPIs live in emails, board decks, financial statements, and other documents shared regularly as part of normal investor communication. Some of our largest customers receive well over 500 portfolio updates and over 1,000 documents every quarter – all flowing directly into Fundra.

Starting today, Fundra automatically extracts KPIs from these investor updates using AI — live for all customers, with real-time extraction as soon as updates are sent.

Extracts KPIs from emails, board decks, financial statements, and other attachments automatically – the full historical time series, using a model trained on thousands of real-world investor updates

Interprets ambiguous reporting periods like “last quarter”, “YTD”, or “last month” and makes sense of actuals vs. forecasts, even if they are not properly labeled

Detects and resolves restated or conflicting values automatically

Deep-links every metric back to its original source for full auditability (down to the cell or a fragment of text, just ⌘-click on any data point in a table or a chart)

Standardizes metrics across companies so benchmarking has actual meaning

Automatically calculates valuation multiples for funding rounds, valuation adjustments, and other valuation events

Includes a new KPI dashboard to track and benchmark portfolio metrics in one place, using standardized definitions and currencies.

It takes seconds answer questions such as: What did our portfolio companies look like when they raised their Series A? What was their underlying performance at the time, and resulting round sizes and valuation multiples?

We're excited to see how this helps funds monitor portfolio performance, manage valuations, and make more informed follow-on decisions – without changing their workflows.

Try it out today and let us know what you think! There's plenty more we're unlocking with this, so stay tuned for updates.

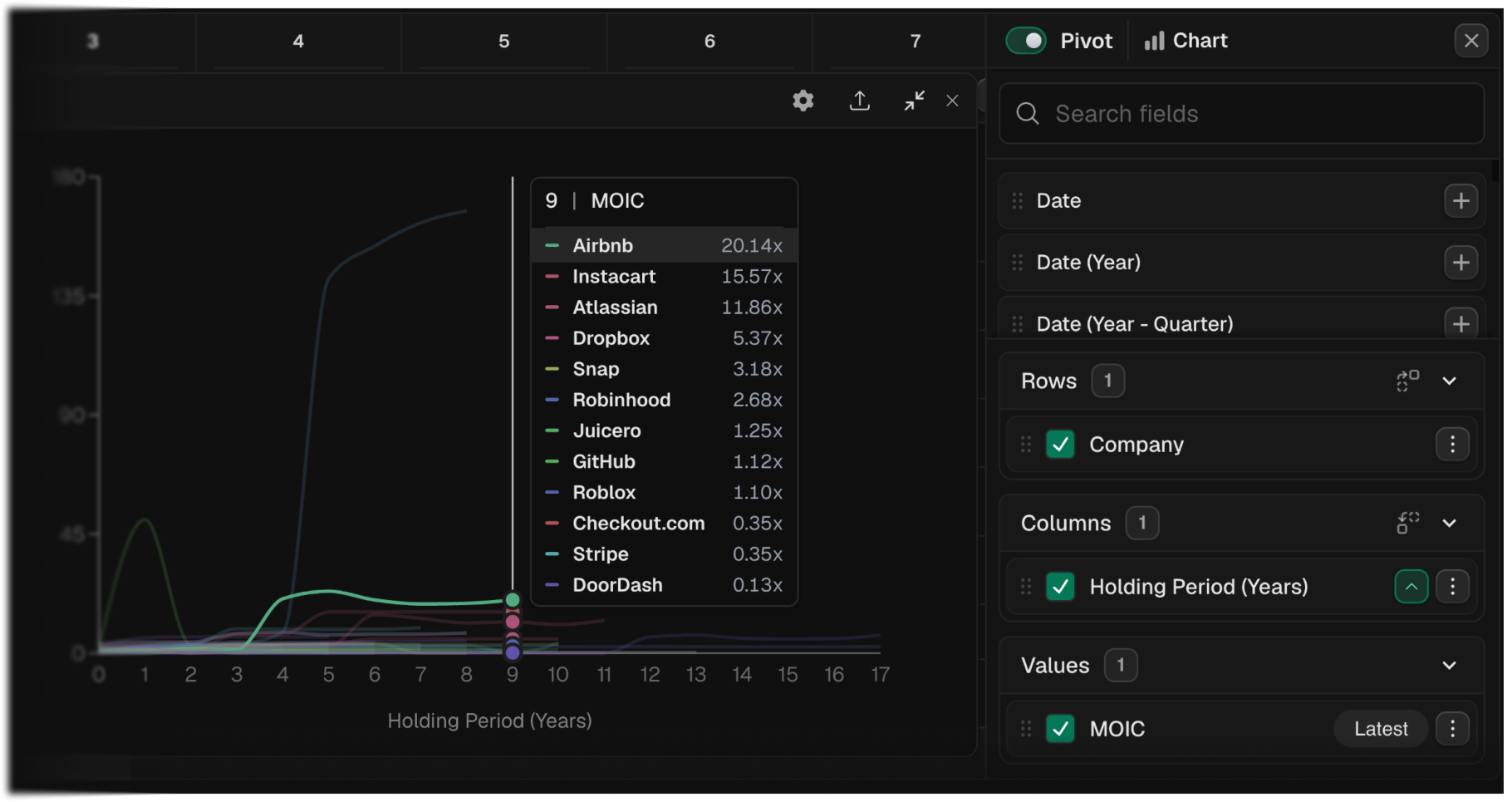

Pivot tables & charts – do more with lessanalytics

Analyze all your data with pivot tables, and create custom charts in just a few clicks

We’re excited to announce pivot tables – a powerful new way to analyze your fund and portfolio company data in Fundra. Whether you're analyzing fund performance, portfolio company metrics, or investment activity, pivot tables give you the flexibility to slice, dice, and visualize your data with ease.

With just a few clicks, you can aggregate and transform your data into custom charts and insights. Easily spot trends across your portfolio, benchmark investment progression, or analyze cap tables over time.

You can build pivot tables from any dataset in Fundra – including:

Portfolio companies

All individual investments

Investment timeline (a new view we added that includesa timeseries of all your investment related activity across all the funds you manage)

Fund performance metrics

And the list goes on – just click the pivot button in the footer of any table to get started.

And as always, you can:

Save your analysis as a reusable custom view

Share insights with your team for better collaboration

Create auto-updating dashboards that reflect real-time data

You can even create a custom view for any chart, which will automatically update as your data evolves.

With pivot tables, Fundra makes it easier than ever to run a data-driven venture fund.

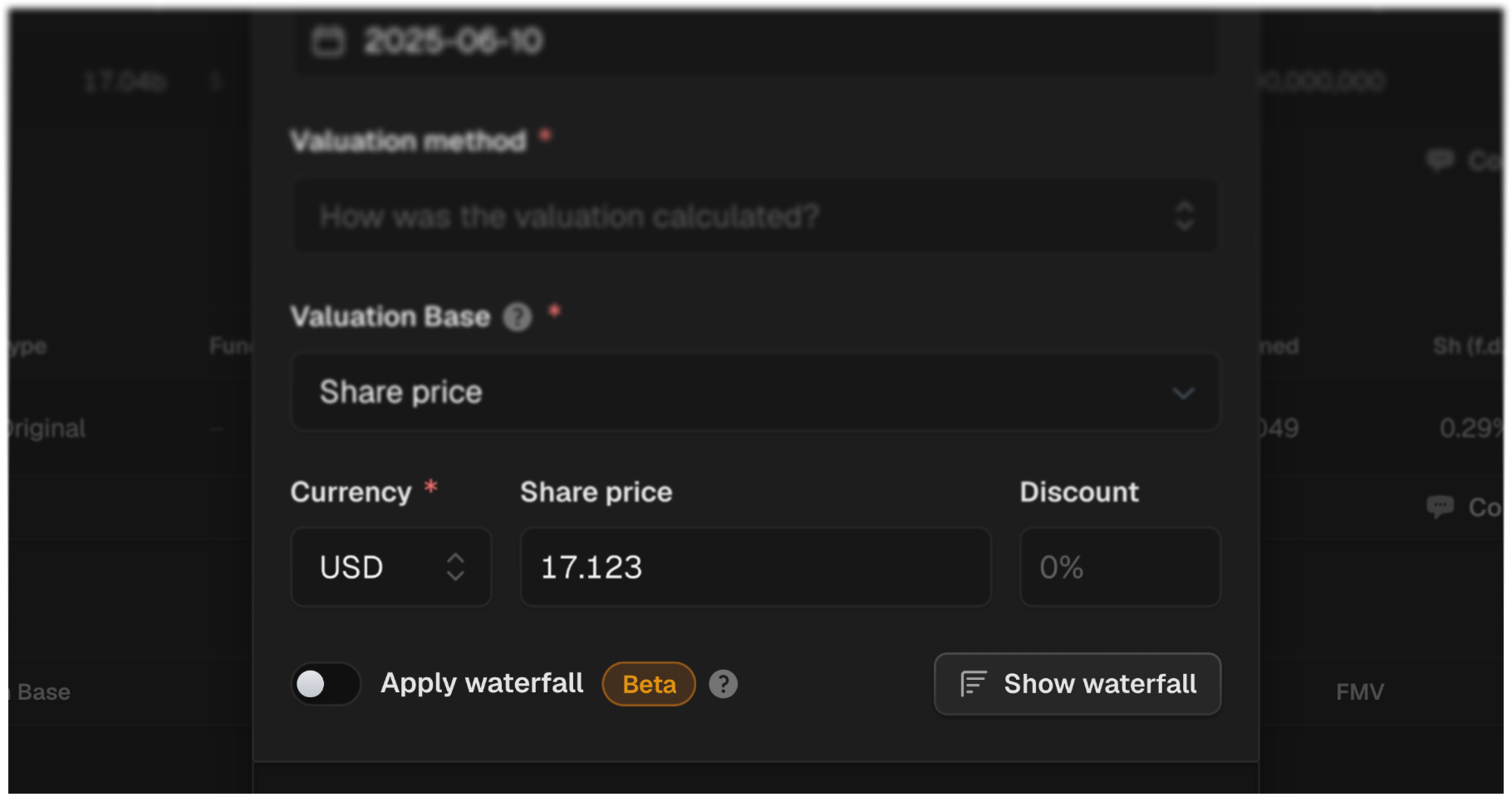

Waterfall modelingbeta

Automatically model valuations and exits against preference stacks – instantly

We’ve just launched waterfall modeling – a new feature that lets you instantly model exit scenarios and distributions across your cap table and share ledger – with all the liquidation preferences, participation rights, and conversion terms baked in.

No more spreadsheets. No more guesswork.

Just enter an exit value (or an EV), and Fundra automatically calculates:

How proceeds are distributed across preferred and common shares

The impact of liquidation preferences, participating preferred, and conversion terms

How much your fund gets under different exit scenarios

Waterfall modeling is essential for:

Exit planning

Fair value reporting to LPs

Evaluating follow-on rounds

You can also apply the waterfall model to a company valuation. It gets automatically adjusted based on the latest cap table data and FX rates, without having to re-create a new model manually every quarter.

This feature is currently in beta, and we’re eager to hear your feedback. There can be some rough edges and unhandled edge cases that we’ll be ironing out in the coming weeks, at which point we'll drop the beta tag.

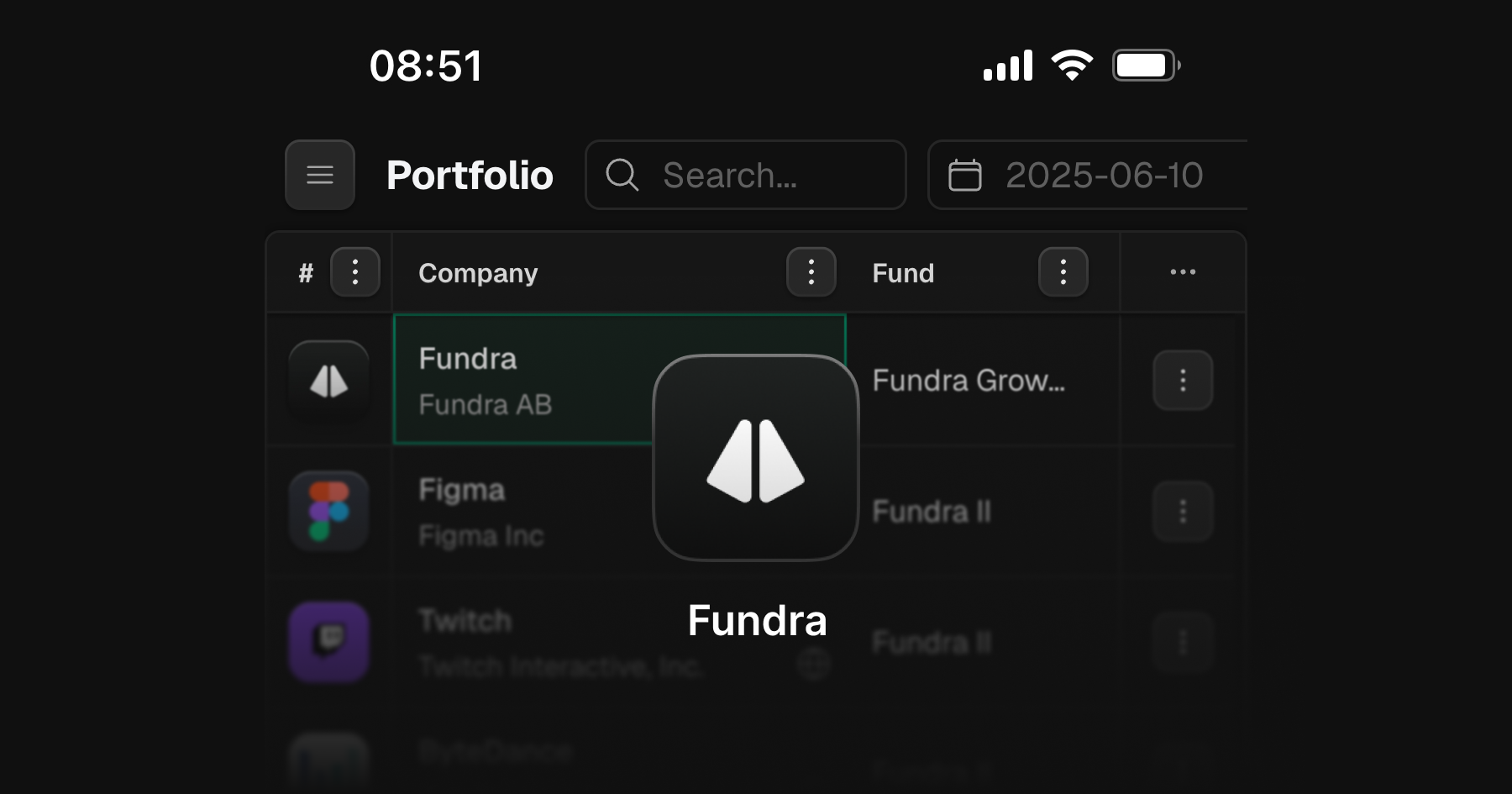

Fundra goes mobile

Install the Fundra app to manage your portfolio on the go!📲

Fundra has been the go-to platform for venture fund portfolio management on web and desktop. But as our users grow beyond investment teams to include marketing, talent, platform, and ops, one thing became clear: Fundra needs to move with you. Hence we've made a big push to make Fundra even easier to use on your phone.

Whether you're in a board meeting, scouting talent, reviewing quarterly updates, or prepping LP material before a meeting – Fundra's mobile app keeps you connected, informed, and effective on the go. Receive notifications, access portfolio data, and collaborate with your team from anywhere.

It's only the first step in our mobile journey, but we’re excited to bring you a seamless experience that complements your desktop workflows.

Ready to take your workflows beyond the desktop? Check log in to your Fundra account on your phone and follow the instructions to install the app.

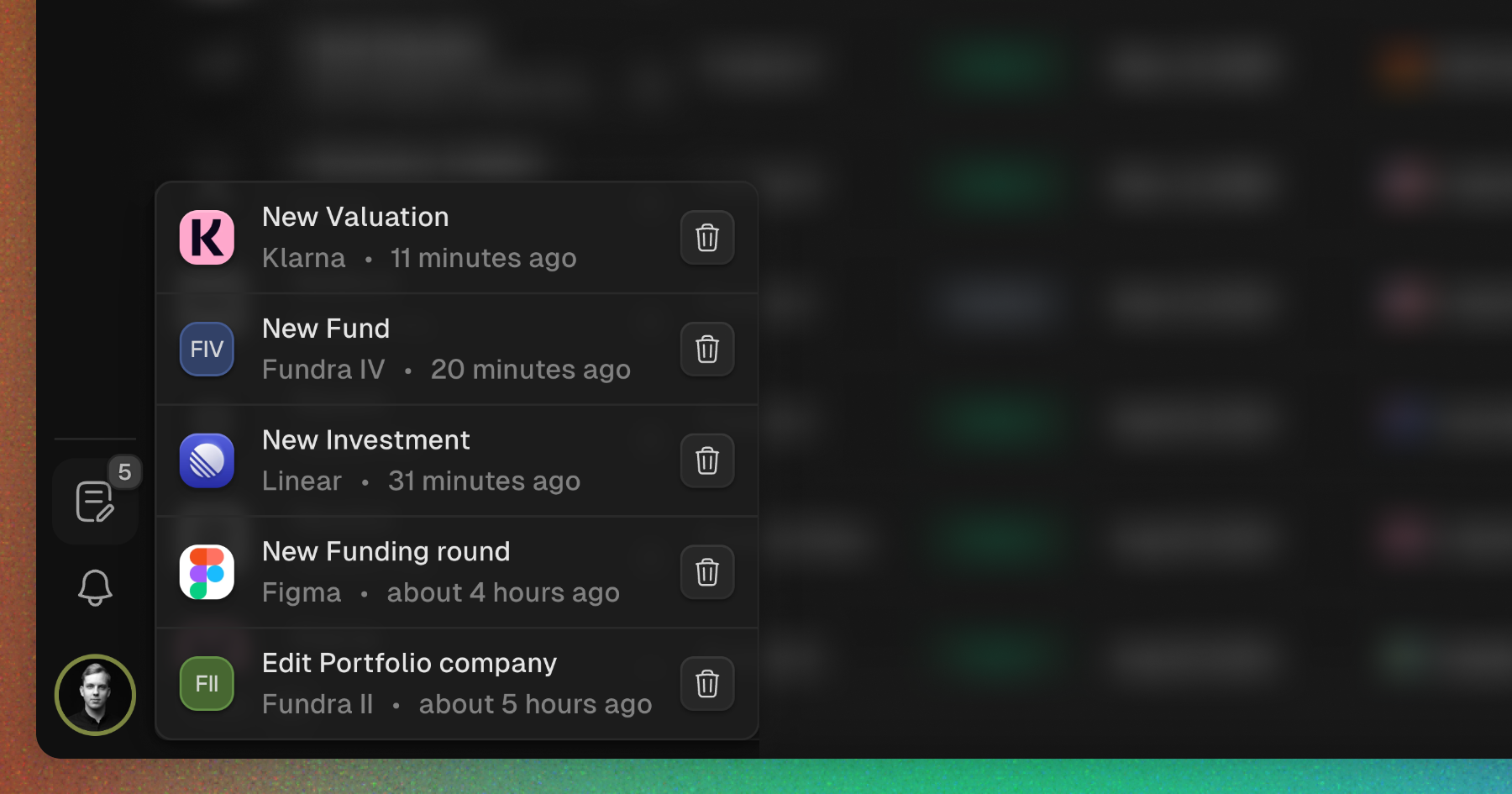

Draft store

Drafts are not a new feature in Fundra, however, they have been somewhat hidden – until now. We have made it much easier to find and manage your ongoing work. We know that there are many occasions where you don't yet have all the information you need to add a new investment, fund, or a portfolio company. Drafts allow you to save your progress and come back later to finish the task.

Now you can easily access all your drafts in one place, making it simple to jump right back into the flow from anywhere in the app.

Fundra has launched!

We’re thrilled to announce that Fundra has officially launched out of private beta! 🎉

Although our public debut is recent, Fundra has already been powering the workflows of several top venture funds behind the scenes. Everything we’ve built so far has been shaped by real-world usage and direct feedback from experienced investors.

This is a major milestone for us, and one that moves us closer to our mission: modernizing venture investing by eliminating the manual busywork that slows everyone down. Today, each venture fund operates like a one-off application — reinventing the wheel, siloing data, and making the process of startup investing more chaotic than it needs to be.

Fundra aims to change that. Think of us as a unified API for venture capital — a central platform where fund managers, founders, and LPs can collaborate, share data, and make decisions faster and more securely.

We’re just getting started, and we can’t wait to show you what’s next.