Waterfall modelingbeta

Automatically model valuations and exits against preference stacks – instantly

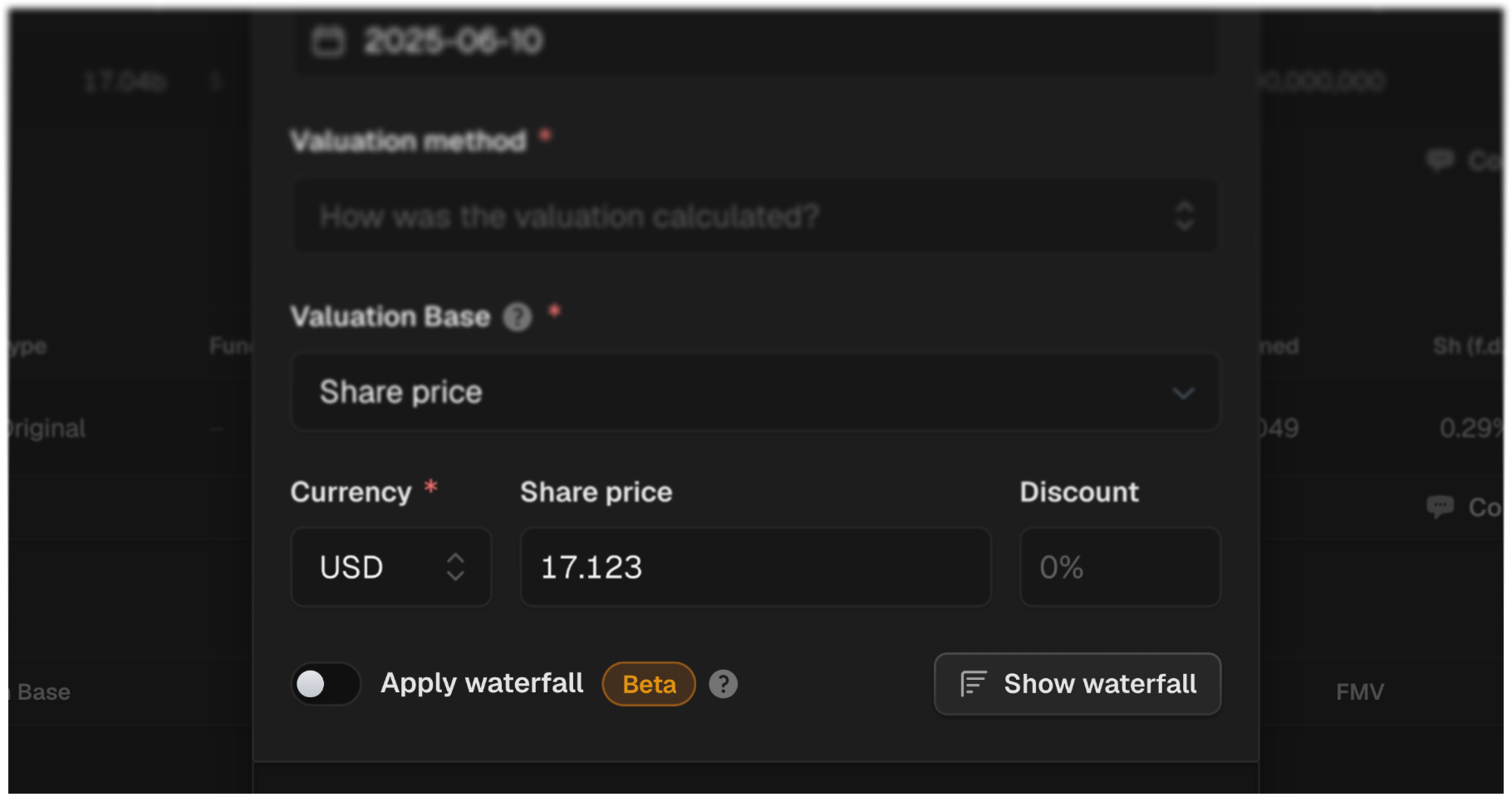

We’ve just launched waterfall modeling – a new feature that lets you instantly model exit scenarios and distributions across your cap table and share ledger – with all the liquidation preferences, participation rights, and conversion terms baked in.

No more spreadsheets. No more guesswork.

Just enter an exit value (or an EV), and Fundra automatically calculates:

How proceeds are distributed across preferred and common shares

The impact of liquidation preferences, participating preferred, and conversion terms

How much your fund gets under different exit scenarios

Waterfall modeling is essential for:

Exit planning

Fair value reporting to LPs

Evaluating follow-on rounds

You can also apply the waterfall model to a company valuation. It gets automatically adjusted based on the latest cap table data and FX rates, without having to re-create a new model manually every quarter.

This feature is currently in beta, and we’re eager to hear your feedback. There can be some rough edges and unhandled edge cases that we’ll be ironing out in the coming weeks, at which point we'll drop the beta tag.